do nonprofits pay taxes in canada

Typically a nonprofit is required to withhold federal income taxes from employee wages and pay a matching amount. Yes even tax-exempt nonprofit organizations must pay the usual payroll taxes for employees.

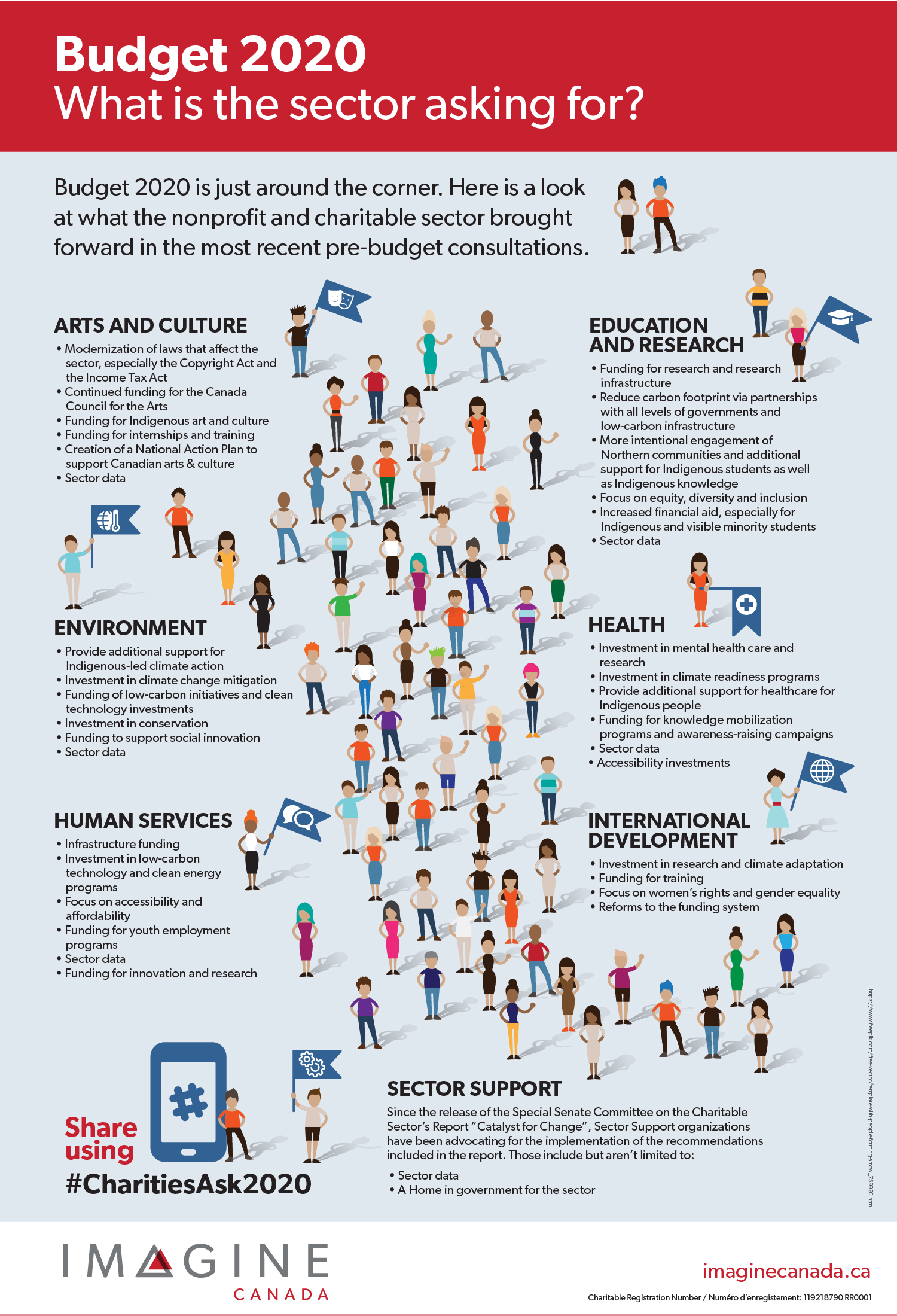

Budget 2020 What S The Sector Asking For Imagine Canada

While the income of a nonprofit organization.

. These taxes include federal. This is an introductionAs a result of being exempt from income tax through the Income Tax Act. Non-profit organizations are exempt from tax under Part 1 of the Income Tax Act for the portion of their fiscal period where they meet the.

GSTHST Information for Non-Profit Organizations. A Canadian nonprofit would not need to pay income tax but they have to use the Canada Revenue Agency in filing their returns. Yes nonprofits must pay federal and state payroll taxes.

The cra bans both of these organizations from using their income to benefit members. If I Work for a Nonprofit Do I Pay Taxes. 501 c 3 organizations are exempt from federal income tax however they.

Nonprofit tax filing requirements vary based on the. Tax time can be. Neither exempt from income tax nor from property tax under the Income Tax Act Canada contrary to what appears to be the intention charitable and non-profit organizations.

Qualifying nonprofits are exempt from paying federal income tax although they may still have to pay excise taxes income tax on unrelated business activities and employment. However here are some factors to consider when. Both charities and nonprofit organizations do not have to pay income tax.

Your recognition as a 501c3 organization exempts you from federal income. Do Nonprofit Organizations Pay Property Taxes In Canada. Do nonprofits pay payroll taxes.

Most are also exempt from state and local property and sales taxes. Most nonprofits do not have to pay federal or state income taxes. Our publications and personalized correspondence are available in braille large print e-text or MP3 for those who have a visual.

Nonprofits are of course not exempt. Do Non-Profit Organizations Pay Tax. Do nonprofit organizations have to pay taxes.

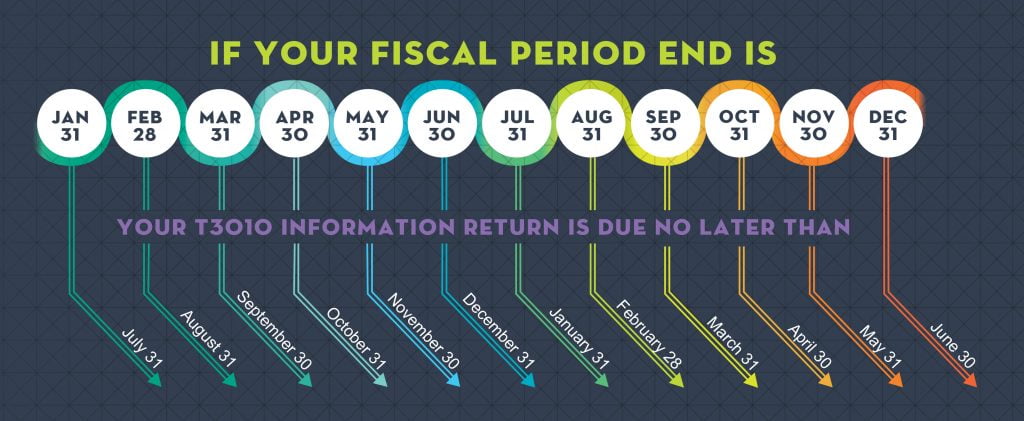

Canadian nonprofits do not need to pay income tax but these organizations still have to file a return with the Canada Revenue Agency. All nonprofits are exempt from federal corporate income taxes.

Accounting And Bookkeeping For Non Profit Organizations Npo Green Quarter Consulting Surrey Bc

Nonprofit Program Budget Template 8 Non Profit Budget Template The Importance Of Having Non Profit Budget Te Budgeting Worksheets Budget Template Budgeting

Charitable Giving By Individuals

Simple Ways To Start A Nonprofit In Canada With Pictures

![]()

Canadian Tax Requirements For Nonprofits Charitable Organizations

Non Profit Vs Not For Profit What S The Difference 2022

![]()

Guide To Gst Hst Information For Nonprofit Organizations Enkel

Community And Non Profit Jobs In Canada Moving To Canada

Four Reasons The Nonprofit Sector Needs A New Name Ontario Nonprofit Network

![]()

Canadian Tax Requirements For Nonprofits Charitable Organizations

Rules Of Engagement The Nonprofit Vote

Sources And Uses Of Incomes In The Nonprofit Sector

Canadian Nonprofits Make Tax Receipts Compliant With Canada Revenue Agency S Regulations Nonprofit Blog